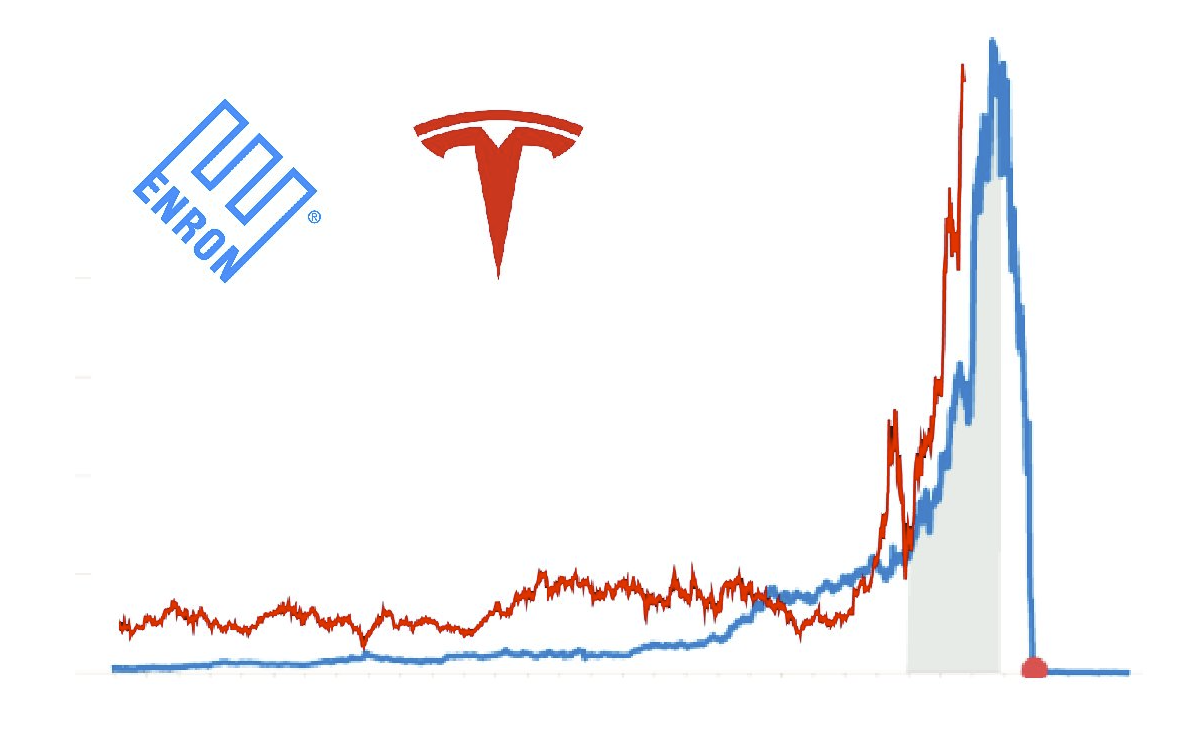

As Tesla’s financial reporting and accounting become more suspect and Elon Musk’s lies become broader and increasingly ludicrous, it harkens back to previous corporate frauds like Enron.

Why are Tesla and Musk able to get away with their fraud?

Charisma and suspensions of belief are a big part of it.

As HBR explained in a previous article, The Curse of the Superstar CEO, written shortly after the fall of Enron in September 2002.

[T]he destructive impact of a charismatic leader can be seen in Jeff Skilling’s ill-fated career at Enron. In this case, the demands of the leader induced blind obedience in his followers. As we now know, Skilling’s abilities as a new economy strategist were considerably overrated. What he clearly excelled at, however, was motivating subordinates to take risks, to “think outside the box”—in short, to do whatever pleased him. One former Enron executive has described the upper managerial ranks of the company as a “yes-man culture.” CFO Andrew Fastow—the alleged designer of the off-the-books partnerships that proved central to Enron’s downfall—was so enamored of Skilling that he reportedly named one of his children after him and hired the architect who designed the CEO’s Houston mansion to design his house.

Enron’s board of directors also bent to the will of its charismatic leader when it agreed to suspend its code of ethics to allow top executives to participate in the off-balance-sheet partnerships. Yet almost to the bitter end, Skilling wowed investors and analysts at gatherings that one analyst likened to revival meetings. As Skilling’s example illustrates, charismatic leaders reject limits to their scope and authority. They rebel against all checks on their power and dismiss the rules and norms that apply to others. As a result, they can exploit the irrational desires of their followers. That’s because following a charismatic leader involves more than merely acknowledging his skills—it requires full surrender.

Enron may seem like an extreme example, but the list of organizations badly crippled by charismatic CEOs includes some of the most respected names in American business.

Jeff Skilling is a very similar character to Elon Musk – highly narcissistic and willing to cut corners in whatever way to get what they want, believing that laws and norms don’t or shouldn’t apply to them.

Will Tesla eventually meet the fate of Enron?

Given Tesla’s extreme valuation as a small car manufacturer, it’s very likely their valuation will eventually fall significantly.

Of course, Tesla falsely pretends to be much more, such as offering full self-driving software, which is only a driver’s assistance system that requires constant monitoring, and new models and products that are not being produced (such as a Semi, CyberTruck, Robot, Solar roofs, Roadster II).

Everything depends on confidence with Musk, and regulators have not yet dropped the hammer in the various ways he could be held accountable. Previous fraud charges have been wholly insufficient.

![Backwards 3: How to Type "Ɛ" [EASY]](https://softwareblade.com/wp-content/uploads/2022/02/Screen-Shot-2022-02-19-at-9.03.25-PM-150x150.png)